In this update we are covering the news stories from April and early May 2024, keeping you informed whether you are managing your own diabetes or doing so as a carer.

DIABETES NEWS

LIBRE 2 PLUS COMING SOON

The new FreeStyle Libre 2 Plus is expected to be rolled out in the UK from the end of May/June.

The sensor is an upgrade from the current Libre 2 sensor with a 15-day wear time for both adults and children. It is the same size and shape as the existing Libre 2 and uses the same app.

The rollout of the Plus version of Libre 2 will open the way for PWD to use Omnipod 5 as a hybrid closed loop (HCL) system, having received CE Mark approval in February 2024.

The FreeStyle Libre 2 Plus sensor already integrates with the t:slim X2 insulin pump from Tandem Diabetes Care Inc for use as a HCL.

Abbott have indicated that there will be a gradual move for all Libre 2 users in the UK to the Libre 2 Plus. In the UK, we know many DSNs are already aware of this change, so if you’re a Libre 2 user you can expect it to come up at your next review.

INSULIN SHORTAGES

Insulin shortages are causing concern in several parts of the world and in the UK this has been covered in the media with articles in both the Guardian and Daily Mail.

The latest supply issues are around the availability of Humalog and Humulin vials, from Eli Lilly - pre-filled pens and cartridges are not affected. It’s not clear how long the disruption to supplies of these insulins will last with Eli Lilly saying “they are actively monitoring this situation and are working to reduce the impact of supply disruptions.”

This follows the news before March, that there was a problem with the production ofpre-filled FlexTouch pens for Fiasp 100units/ml and Tresiba 100units/ml, manufactured by Novo Nordisk.

Users of these pens are being told to switch to use cartridges or a different insulin as production issues are likely to continue until the end of the year.A reminder that you can see alternatives for insulins on the Diabetes 101 website (used by DSNs) here.

Meanwhile, Novo Nordisk’s Insulatard Innolet and Levemir Innolet devices have been discontinuedwith remaining stock likely to run out by the end of May 2024. Levemir FlexPens and Levemir Penfill cartridges remain available.

There are also shortages in the US, Eli Lilly warned that“10 mL vials of Humalog and Insulin Lispro Injection are or will be temporarily out of stock at wholesalers and some pharmacies through the beginning of April,"

GLP-1 SHORTAGES

The NHS are currently experiencing shortages of supplies of the following GLP-1 RA medications - Ozempic, Trulicity, Victoza, Saxenda, Byetta, and Bydureon.

Limited supplies of Wegovy and Saxenda are available through specialist weight management services only.

Mounjaro has now been approved by the National Institute for Health and Care Excellence (NICE) for use within England and Wales and Northern Ireland and can be prescribed to people living with type 2 diabetes in England who are unable to obtain Ozempic, Trulicity or other GLP-1 medications.

| MyFitnessPal announced a new set of tools and content to support members taking GLP-1 medications. |

NHS ROLLS OUT HYBRID CLOSED LOOP TECHNOLOGY

Hybrid Closed Loop (HCL) technology has now started to roll out in the UK under the NHS for type 1 diabetes management. The news was reported on the BBC, Sky News and in newspapers such as the Guardian, referring to it as an artificial pancreas, it was hailed as "a world-first initiative".

However, whilst the impression is that everyone will soon be using a HCL, this is subject to eligibility criteria and it may take up to 5 years before those that are eligible receive the technology.

The headline figure is that around 150,000 of those with type 1 diabetes (often quoted as being 300,000 or even 400,000) are likely to be considered for HCL.

The most recent NHS Diabetes Audit for 2023 (collated from 98.5% of GP surgeries) shows that there are 270,905 registered type 1s in England, and although the data is incomplete, this leaves a large number without access. The data also shows 39.7% have a HbA1c or 7.5% or lower, potentially meaning they won't meet the eligibility criteria.

Click here for more about HCL and eligibility criteria.

DRWF CHARITY NEWS

UK charity, Diabetes Research & Wellness Foundation (DRWF) have produced new information leaflets on healthy eating, eye care and diabetes management when you are ill. These are free guides available to download from their website. Click here.

And don’t forget DRWF are hosting their annual 'United through diabetes' conference in Warwickshire on 21st September 2024.

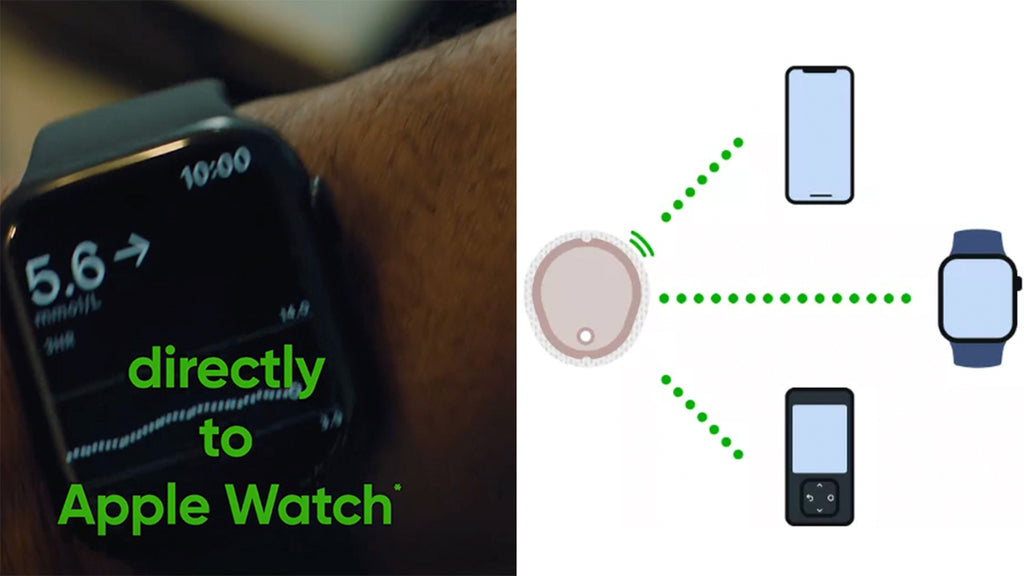

DEXCOM DIRECT TO SMARTWATCH LAUNCHED IN UK

Dexcom Direct to Smartwatch is now available for G7 in the UK and Ireland. Other European countries are set to follow in the next few months.

SENSEONICS IMPLANTABLE CGM GETS US CLEARNACE TO LOOP

In the US, the FDA have granted Senseonics’ Eversense device the designation of iCGM, meaning its implantable sensor can be used with pumps as part of an automated insulin delivery system ie. hybrid closed loop.

The Eversense can currently be implanted (by a short medical procedure) under the skin for up to 180 days, though it requires daily calibration by a finger prick test after 21 days and when symptoms don’t match. Senseonics iCGM designation could see patients being free of the need to change their CGM every 2 weeks with plans by the company to extend the wear time of their iCGM to up to 365 days!

The company are also aiming to remove the need for PWD to wear an on-body transmitter and are working on self-powered implants. Human testing is due to start later in 2024.

US DRUG PRICING [INSULIN]

An investigation in the US, led by former president-hopeful Bernie Sanders, has been launched into the 'Outrageously high price' of Ozempic and Wegovy there.

Comparing the cost of Ozempic at $969 and Wegovy at $1,349 in the US, Senator Sanders, cited the cost of Ozempic as only $155 in Canada and $59 in Germany, while Wegovy costs $140 in Germany and $92 in the UK. He also commented that “[insulin] can be profitably manufactured for less than $5 a month.”

Read more here.

MEDTECH DATA

This month many of the Medtech companies have been collating their sales for the first 3 months of 2024 and reporting these to investors.

Whilst not of obvious interest to those with diabetes, it does give an insight into how the sector is growing and the emphasis (or not) on treating those with the condition. The latest data showing the growth in weight loss medication and how use of CGMs is pivoting to those with type 2 and those who using the medtech for reasons other than diabetes.

ABBOTT REPORTS SALES GROWTH

Abbott announced their sales figures for the first quarter of this year reporting that in terms of diabetes care, FreeStyle Libre sales reached $1.5 billion, representing sales growth of over 20%.

It’s probably not surprising to hear that FreeStyle Libre are the dominant player in the CGM market, with over 5 million users globally, including more than 2 million in the US.

DEXCOM UPDATE

In April, Dexcom reported sales growth of over 25% in the first quarter of 2024. Further growth in CGM sales is expected as the company push ahead with their Stelo CGM for type 2 diabetes management, based on the G7.

NOVO NORDISK MARKET DOMINANCE

The Danish company, Novo Nordisk, is Europe’s most valuable company (and now bigger than the Danish economy) with an estimated worth of over $570 billion and the world’s largest producer of insulin. Inthe first three months of 2024 sales grew by 28%and the company claim to have an 85.4% share of the global obesity care market.

Novo Nordisk recently announced that Levemir is to be discontinued. Investors have suggested that insulin will become a smaller and smaller part of Novo's business as they look to the rapidly growing market of weight loss drugs, leading the way with Ozempic and Wegovy.

ELI LILLY LATEST

Sales of Mounjaro and Zepbound have contributed to Eli Lilly's latest sales figures showing growth of over 26% in the first 3 months of the year. The success of the weight loss drugs has led to shortages of supply which the company are known to be addressing by increasing production although this is taking time and shortages may continue until the end of the year.

***

That's it, you're up-to-date!

Thank your for reading. We hope you've found these stories insightful. If you have any comments please email us - hello@lovemylibre.com

If you're not currently a member of our community please join us by subscribe below. We look forward to welcoming you!

***

Disclaimer

Blogs and publications on this website are independent of any involvement by medtech companies or diabetes related charities. To ensure there is no bias, we do not accept any products, freebies or other material from any medtech provider. Except where credited otherwise, all materials are copyright ©️Love My Libre Ltd.

Love My Libre is not associated or affiliated with Abbott or FreeStyle Libre. Content here and on our website www.lovemylibre.com does not constitute medical advice or replace the relationship between you and healthcare professionals nor the advice you receive from them.

The author of this blog has type 1 diabetes and uses the FreeStyle Libre 2 which is provided on NHS prescription.

Leave a comment (all fields required). Please note, we are unable to respond to individual comments posted here.