Medtech Update Spring 2024

Read on for insights into this year’s plans for Dexcom, FreeStyle Libre, Roche, Omnipod, Medtronic and more…

The annual ATTD (Advanced Technologies & Treatments for Diabetes) Conference was recently held in Florence, Italy and many medtech companies take the opportunity at this key event in the diabetes calendar, to announce or even launch, new products or developments in their medtech.

The event is attended by over 5,000 people from at least 95 countries around the world, including many senior healthcare professionals, diabetes specialists and experts. It’s a chance for attendees to learn about the latest innovations in diabetes research, treatments and technologies.

In this blog we are delighted to bring you an overview of some of the developments in medtech together with what’s ahead for 2024.

Updates from current diabetes medtech providers

Dexcom

Image courtesy of Dexcom Inc

Dexcom made several announcements at ATTD, including:

Direct-to-Watch feature for G7 (now FDA cleared). This means that the G7 will be the only CGM that can connect directly to an Apple watch without needing to carry an iPhone. The company plans a phased launch for all G7 iOS users everywhere by the end of the second quarter of this year and those who use G7 can access this feature as soon as it launches in their country.

Dexcom have also launched the Dexcom ONE+ - based on G7, a separate transmitter is not needed - in new countries stating that following on from the Eurpean launch around a month ago, it's now available in 8 markets.

Dexcom have more data backing its technology which can now be used in hybrid closed loop/AID with Tandem Diabetes Care t:slim X2 pump and Insulet Omnipod 5.

Dexcom are growing their market quickly and confirmed that the Dexcom G7 has become available in an additional 16 new countries since last year's ATTD conference.

Dexcom's Stelo, a sensor especially for those with type 2 diabetics, is expected to launch later this year. It will be available over-the-counter and has a 15 day-wear time.

FreeStyle Libre

Image courtesy of Abbott

Abbott have been collating data from use of their FreeStyle Libre by type 2s and report that when used in conjunction with GLP-1s, like Wegovy or Ozempic, those with type 2 diabetes were able to reduce their HbA1c more than without these of CGM.

FreeStyle Libre 2 Plus is now available in the US for AID and Freestyle Libre 3 Plus is likely to follow soon. Libre 2 Plus has a 15 day wear time and can integrate with the Tandem t:slim X2 insulin pump.

Omnipod

Image courtesy of Insulet Inc

Recent data has shown Insulet – owner of Ominipod brand - as the fastest-growing insulin pump company and the global leader in tubeless insulin pump technology.

Company plans include expanding the use of Omnipod 5 to type 2s in the US with FDA clearance this year.

This follows an announcement that recent trials, carried out in the United States and France have shown strong evidence that use of the Omnipod 5 for Automated Insulin Delivery i.e. hybrid closed loop, delivers really positive outcomes for T1s. The trials compared to insulin pump therapy with continuous glucose monitoring, for T1D management and saw the following overall outcomes for those using Omnipod 5:

- 5% improvement in time in range – that’s 4.2 hours per day in range!

- decreased HbA1c

- decreased percentage of time in hypoglycaemia

- decreased mean glucose in individuals with baseline HbA1c levels above the recommended target.

It is the first Omnipod 5 randomised controlled trial to date, and the first time evaluation has involved international participants.

In February, the Omnipod 5 achieved CE mark approval for integration with the FreeStyle Libre 2 Plus and it’s expected this will start to rollout out in the UK and Netherlands in the first half of 2024, with additional countries to follow.

| Although it's know that both Tandem Diabetes Care andMedtronic are working on patch pumps, similar to the Omnipod 5, Insulet have suggested that it will taken their competitors another year-and-a half before catching up. |

Medtronic

Image courtesy of Medtronic Inc

In news from Medtronic, investors have been told that the company is "aggressively moving" to bring their next generation of tethered and patch pumps to market.

To achieve this, Medtronic are expected to launch their first all-in-one wearable CGM, the Simplera in Europe in mid-2024. The Simplera can be used with the InPen smart insulin pen, or with a MiniMed 780G pump using the Simplera Sync.

At ATTD Medtronic shared the results of the largest set of data from early MiniMed 780G automated insulin delivery system users in the US which covered 3 years of information and more than 100,000 real-world users.

Medtronic have been using a new measure of time in tight range (TITR) defined as the percentage of time a person spends in the glucose range of 4-7.8 mmol/L (70-140 mg/dL) to evaluate the MiniMed 78G. This newer metric more closely mirrors the glucose levels of individuals without diabetes.

Medtronic's results showed that users (13,461) achieved a TITR of greater than 56% when using optimal settings recommended by the company - a set target of 5.4 mmol/L (100 mg/dL) with an active insulin time of 2 hours.

Tandem Diabetes Care

Image courtesy of Tandem Diabetes Care Inc

Tandem plan to offer a tubeless option of their Mobi pump, so that users can wear it as a tubed pump and also patch device, switching as desired by the wearer. They are also developing a rechargeable patch-pump that uses prefilled cartridges, called Sigi.

The Mobi has now launched in the US.

Medtech DataThe global insulin pump device market is expected to be worth $14.1bn by 2033 with the CGM sensor market forecast to grow to $5bn by the same year. Currently, Medtronic and Abbott occupy the greatest market share of insulin pumps and CGMs, with a 20.5% and 19% share respectively. Dexcom has a 9.2% share. Data from GlobalData, March 2024. |

Brand new Medtech

Roche

Image courtesy of Roche Ltd

Roche used the ATTD event to announce a brand new CGM system, the Accu-Chek SmartGuide. The sensor has a wear time of 14 days, however, it does require calibrating by carrying out a finger-prick at initiation of each new sensor.

There is a warm-up time of 1 hour & the MARD is stated to be 9.2% - higher than Dexcom’s G6 & G7 and also FreeStyle Libre 2 & 3, so less accurate.

Where the system differs from other CGMs particularly is in its ability to integrate AI and customise glucose predictions and prevention recommendations over two hours during the day, and up to seven hours overnight.

Some community members have already suggested that the finger-prick calibration is a backwards.

Roche hope to get a CE mark for the Accu-Chek SmartGuide soon and plan to sell the device in “selected European countries” soon after receiving clearance.

Click hereto find out more.

KnowU

Image courtesy of Know U Labs

A new developer of diabetes medtech, Seattle-based (US), Know Labs are looking to deliver the world's first wearable non-invasive glucose monitor.

The company have developed a proprietary sensor which can detect glucose levels using new radio frequency technology, without the need for a needle or filament to be inserted in the skin. They now plan to submit their KnowU CGM for clearance by the FDA.

The KnowU is designed to be worn with an adhesive or strap, so can be clipped on and off easily, and worn either on the wrist or upper arm.

It is intended the product will have a long life with the use of rechargeable battery, eliminating the use of costly disposables.

The reported MARD (mean absolute relative difference) is 11.1%. This can be compared with invasive CGMs from Dexcom and Abbott which have demonstrated higher levels of accuracy – 8.2% for G7and 7.6% for FreeStyle Libre 3.

Read more and watch a video of the product here.

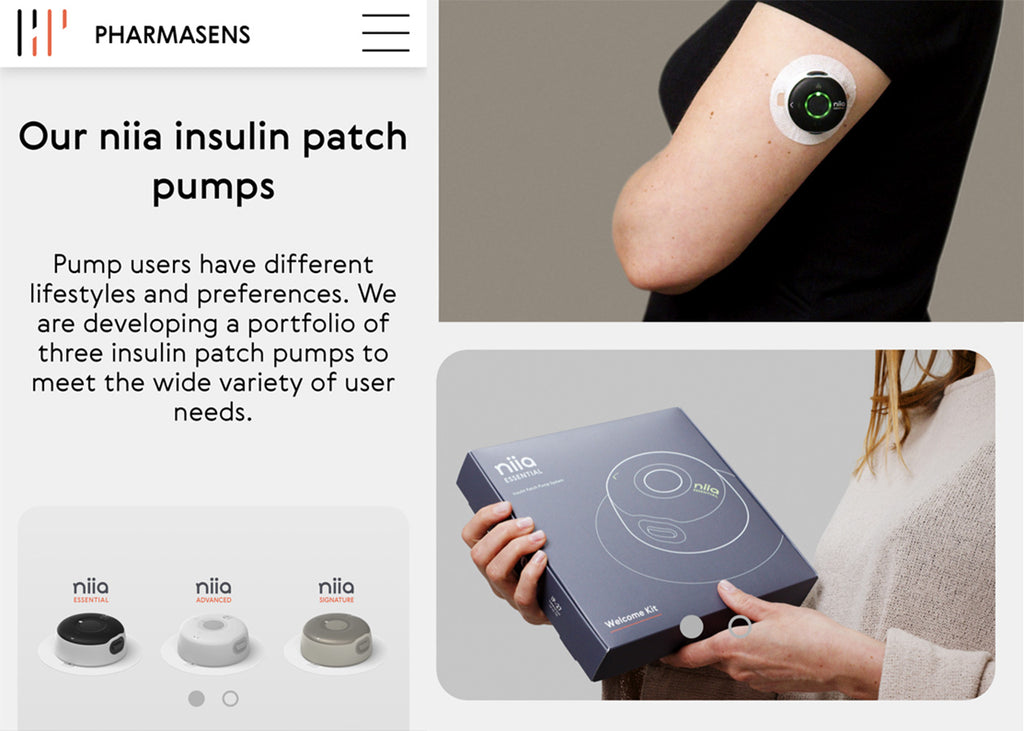

Pharmasens

Image courtesy of PharmaSens

PharmaSens, a privately onwned medtech company based in Switzerland, have submitted plans for their "niia essential" insulin pump system to the FDA for approval.

The "niia essential" system is a basal-bolus patch pump and the first of a three patch pumps developed by the company. Products have been designed with a focus on patient needs and ease of use at their core.

The designs of PharmSens products are really innovative and stylish with the company specifically tailoring their approach to "meet the unmet needs of the almost pumpers", an untapped market estimated to value around US$10 billion.

The styles could certainly revolutionise the image of wearing a pump! Click here for more information.

Twiist™ AID system

Image courtesy of Sequel

Tidepool have announced a new partnership a new partnership with Sequel Med Tech following FDA clearance. Sequel’s twiist Automated Insulin Delivery (AID) system powered by Tidepool for people ages 6 and up with type 1 diabetes.

The twiist AID system, which will be commercialized by Sequel Med Tech, LLC, is the first drug delivery system that directly measures the volume and flow of insulin delivered with every micro-dose.

Using the technology, insulin delivery will automatically be adjusted from calculations made by Tidepool's algorithm and based on CGM readings and predicted glucose levels.

Kaleido

Image courtesy of Kaleido

Kaleido is one of the world’s smallest and lightest insulin patch pumps. Users can wear their pump as a patch or place it in their pocket at their own discretion. The system comes with two durable pumps that are rechargeable, eliminating the need to dispose of the pump every 3 days as other patch pumps do. It is available in 10 bright colours and provides the ability to pause or take the pump off for intermittent breaks.

It is currently available in Germany, the Netherlands and France with its commercial partner Diabeloop. We expect Kaleido to rollout to more countries including the UK and Italy in 2024.

Find out more here.

More updates may appear here. Please check-back soon!

Disclaimer

Blogs and publications on this website are independent of any involvement by medtech companies or diabetes related charities. To ensure there is no bias, we do not accept any products, freebies or other material from any medtech provider. Except where credited otherwise, all materials are copyright ©️Love My Libre Ltd.

Love My Libre is not associated or affiliated with Abbott or FreeStyle Libre. Content here and on our website www.lovemylibre.com does not constitute medical advice or replace the relationship between you and healthcare professionals nor the advice you receive from them.

The author of this blog has type 1 diabetes and uses the FreeStyle Libre 2 which is provided on NHS prescription.